How to Create a Cash Flow Forecast for Your Small Business (Free Template Inside)

Running a business is exciting, but it can also be financially unpredictable — especially in the early stages. One of the smartest moves you can make as a small business owner is learning how to forecast your cash flow. It’s a simple, effective way to gain clarity around your finances and avoid unpleasant surprises down the road.

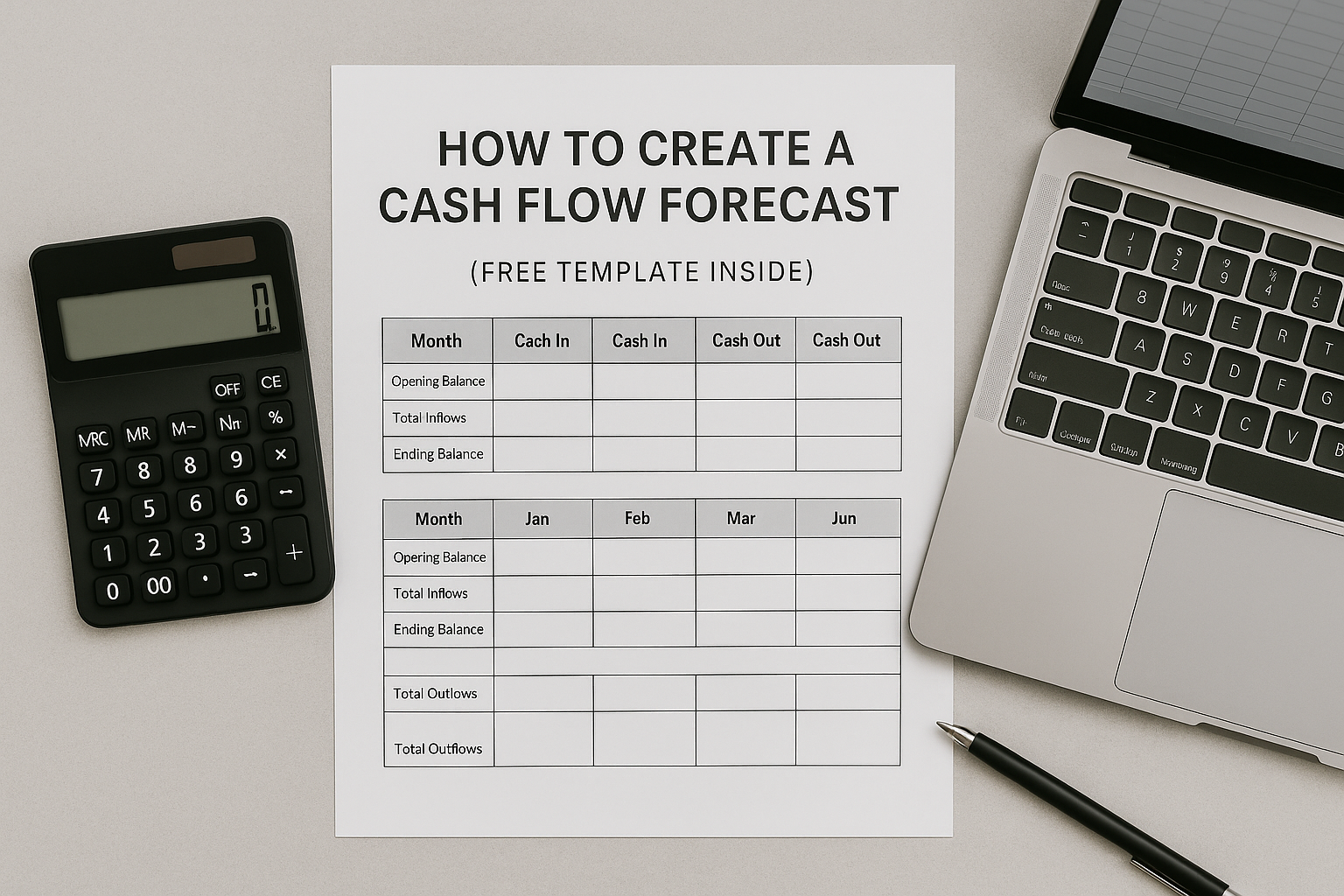

In this guide, I’ll break down exactly what a cash flow forecast is, why you need one, and how to create your own. (Plus, grab a free editable template to get you started.)

📊 What Is a Cash Flow Forecast?

A cash flow forecast is a financial tool that estimates how much money will flow in and out of your business over a specific period — typically weekly, monthly, or quarterly.

It predicts whether you’ll have enough cash to cover expenses, pay yourself, and invest in new opportunities. The key difference between a cash flow forecast and a budget is timing: your forecast tracks when cash actually enters and leaves your account, not just how you plan to spend it.

📌 Why Cash Flow Forecasting Matters for Small Businesses

Here’s why every freelancer, small business owner, and entrepreneur should have a cash flow forecast:

- 📅 Stay financially prepared for slow periods.

- 💡 Make smarter decisions about when to invest, hire, or hold off.

- 🧘 Reduce financial anxiety with a clear picture of upcoming cash.

- 🌸 Manage seasonality and predict busy and slow months.

📋 What You’ll Need Before You Start

Before building your forecast, gather:

- A list of expected income sources (client payments, sales, affiliate income, etc.)

- A list of recurring and one-off expenses (subscriptions, rent, contractors, software)

- Your starting bank balance

- A spreadsheet or cash flow forecast template — grab my free one here

📝 How to Create a Cash Flow Forecast in 5 Steps

1️⃣ List Your Starting Cash Balance

Start with the current amount in your business bank account. This is your opening balance.

2️⃣ Estimate Your Incoming Cash

List every expected source of income for each period:

- Client payments

- Product sales

- Digital product income

- Affiliate revenue

Pro Tip: Be realistic — don’t include income unless it’s confirmed.

3️⃣ Estimate Your Outgoing Cash

Write down every expected expense:

- Rent or coworking space

- Payroll or freelancer payments

- Software subscriptions

- Marketing and ads

- Taxes

- Equipment or inventory purchases

Include both regular and occasional expenses like annual insurance renewals.

4️⃣ Calculate Your Net Cash Flow

Subtract total expenses from total income for each period.

If it’s positive — great!

If it’s negative, make adjustments by reducing costs or delaying expenses.

5️⃣ Update Your Cash Balance

Add your net cash flow to your starting balance for the new ending balance.

This becomes next month’s starting point.

📌 Quick tip: Update your forecast monthly as new income or expenses pop up.

📈 Common Cash Flow Forecasting Mistakes to Avoid

- 🚫 Overestimating income or underestimating expenses.

- 🚫 Forgetting irregular costs like quarterly taxes or annual software renewals.

- 🚫 Letting your forecast gather dust — review and update regularly.

📌 Final Thoughts: Stay Proactive with Your Cash Flow

Creating a cash flow forecast is one of the simplest, smartest ways to stay ahead of your business finances. It takes the guesswork out of decision-making and helps you run your business with confidence.

🎁 Want a head start?

Download my free cash flow forecast template here.